Introduction:

Trading in the stock market is not just about analyzing charts and making informed decisions. It’s a mental game that requires a deep understanding of trading psychology.

Whether you are a seasoned trader or just starting out, recognizing and managing your emotions is crucial for success.

In this article, we will explore the fascinating world of trading psychology and delve into topics like stock market psychology, candlestick psychology, emotions in trading, and option trading psychology.

By the end, you will gain valuable insights into the psychological aspects of trading and learn how to make better decisions in the dynamic world of the stock market.

Understanding Stock Market Psychology:

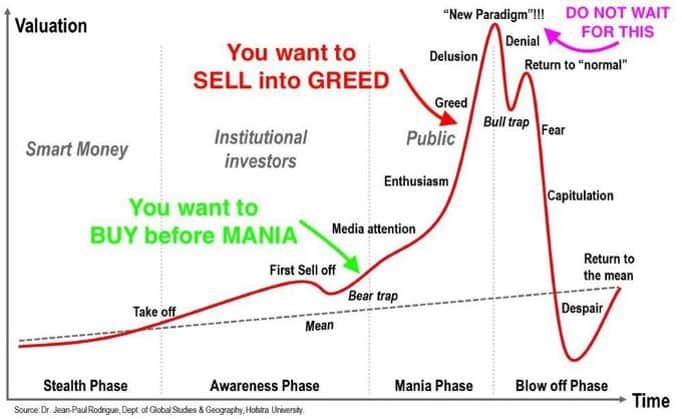

Stock market psychology refers to the collective emotions and behavior of traders that influence market movements.

Fear and greed are the two primary emotions that drive market participants. When fear dominates, panic selling occurs, leading to a downward spiral in stock prices.

Conversely, excessive greed can fuel speculative buying, causing overvaluation. Understanding these emotions can help traders navigate through market volatility.

Candlestick Psychology: Decoding Chart Patterns

Candlestick charts are popular tools used in technical analysis. They not only provide visual representation of price movements but also reflect the psychology of market participants.

For example, a long green candlestick indicates bullish sentiment, while a long red candlestick suggests bearish sentiment.

Recognizing these patterns can help traders make informed decisions. However, it is essential to avoid emotional biases and rely on objective analysis when interpreting candlestick patterns.

Emotions in Trading: Controlling the Mind

Emotions play a significant role in trading. Fear, greed, and even overconfidence can cloud judgment and lead to impulsive decisions.

Successful traders are those who learn to manage their emotions effectively. One effective approach is to have a well-defined trading plan that includes entry and exit points.

This plan acts as a guide, reducing the influence of emotions during trading. Additionally, practicing mindfulness and maintaining a balanced lifestyle can help in maintaining emotional stability.

Free course: Master Options Trading

Join our FREE options trading course and gain valuable insights into the world of options trading. Learn essential strategies, risk management techniques, and the keys to making informed decisions.

Learn nowOption Trading Psychology: Navigating Complex Strategies

Option trading involves a higher level of complexity and risk compared to traditional stock trading.

Thus, mastering option trading psychology is essential for success. Options offer leverage and flexibility, but they can also amplify emotions.

Traders must be aware of the psychological challenges posed by options, such as the fear of missing out (FOMO) or the fear of losing a substantial amount of money.

It is crucial to thoroughly understand options, have a well-structured risk management plan, and avoid emotional decision-making while trading options.

Story on trading psychology:

Once upon a time, in a small town in India, there lived a trader named Rahul. Rahul had always been fascinated by the stock market and dreamed of becoming a successful trader. He spent countless hours studying charts, learning about different trading strategies, and analyzing companies. He believed that with the right information and skills, he could conquer the stock market and achieve financial freedom.

Rahul began his trading journey with high hopes and a pocket full of dreams. He made his first trade and, to his surprise, it turned out to be profitable. Excited by his initial success, Rahul became overconfident. He started taking more risks, disregarding proper risk management and discipline. Unfortunately, luck was not on his side, and he suffered a significant loss.

Confused and frustrated, Rahul began to question his abilities as a trader. He wondered how he could make a profit one day and lose everything the next. It was then that Rahul stumbled upon an article about trading psychology. Intrigued, he decided to explore this aspect of trading that he had never paid much attention to before.

Rahul discovered that trading psychology was all about understanding the impact of emotions on trading decisions. He learned that fear and greed were common emotions that influenced traders. Fear made them sell prematurely, missing out on potential profits, while greed blinded them to risks and caused them to hold on to losing trades for too long.

As Rahul delved deeper into trading psychology, he realized that controlling his emotions was the key to success. He learned to manage fear by setting stop-loss orders and sticking to them, avoiding impulsive decisions. He also understood the importance of maintaining a calm and rational mindset, even during periods of market volatility.

Armed with this newfound knowledge, Rahul started implementing trading psychology techniques in his daily routine. He practiced mindfulness and meditation to stay focused and disciplined. He developed a trading plan that outlined his entry and exit points, enabling him to make objective decisions based on analysis rather than emotions.

Over time, Rahul noticed a remarkable change in his trading results. He was no longer swayed by short-term market fluctuations or influenced by others’ opinions. Instead, he remained steadfast in his trading strategy and trusted his analysis. As a result, his profits started to grow consistently.

Trading psychology had transformed Rahul’s trading journey. It taught him the importance of self-awareness and emotional control. He learned that success in the stock market was not solely dependent on technical knowledge but also on understanding one’s own psychological biases and tendencies.

With his newfound confidence and discipline, Rahul continued his trading journey. He still faced ups and downs, but he approached them with a clear mind and a solid understanding of trading psychology. And with each trade, he came closer to achieving his dreams, one step at a time.

The story of Rahul serves as a reminder to all traders that trading psychology is not just a fancy term but a vital aspect of successful trading. By mastering their emotions and maintaining a disciplined mindset, traders can navigate the unpredictable world of the stock market with confidence and increase their chances of long-term success.

Conclusion:

Trading psychology is often an overlooked aspect of successful trading.

By understanding stock market psychology, decoding candlestick patterns, managing emotions, and navigating option trading with a balanced mindset, traders can gain an edge in the market.

Developing self-awareness and discipline is the key to mastering trading psychology. Remember, it’s not just about analyzing charts and numbers; it’s about understanding the psychology behind the numbers.

So, invest in your mindset, control your emotions, and embark on a journey to becoming a more successful trader.

Free course: Master Options Trading

Join our FREE options trading course and gain valuable insights into the world of options trading. Learn essential strategies, risk management techniques, and the keys to making informed decisions.

Learn now