Mastering Trade Psychology: Unlock Your Trading Potential

Welcome to Trade Psychology, your go-to resource for unlocking the mental edge needed to succeed in trading. Trading isn’t just about numbers and charts—it’s about understanding the psychology of money and how your emotions, biases, and mindset shape every decision.

Why Trade Psychology Matters?

Cognitive Biases

Risk Management

Top Resources for Mastering Trade Psychology

What Our Community Says?

Latest Insights on Trade Psychology

Recent Posts

The Psychology of Money: A Complete Guide

How to Trade Options Profitably: A Step-by-Step Guide

Reversal Trading with Option Chain | 6 Kinds of Reversals

Mastering Option Trading: A Scalping Strategy for Beginners

Frequently Asked Questions

Some of the FAQ's you might have

What is trade psychology and why does it matter?

Trade psychology explores how your emotions and thoughts affect trading decisions. It’s crucial because a strong mindset can lead to consistent profits, while an unchecked one can cause costly errors. At Trade Psychology, we help you master this for smarter trading.

How do emotions affect my trading decisions?

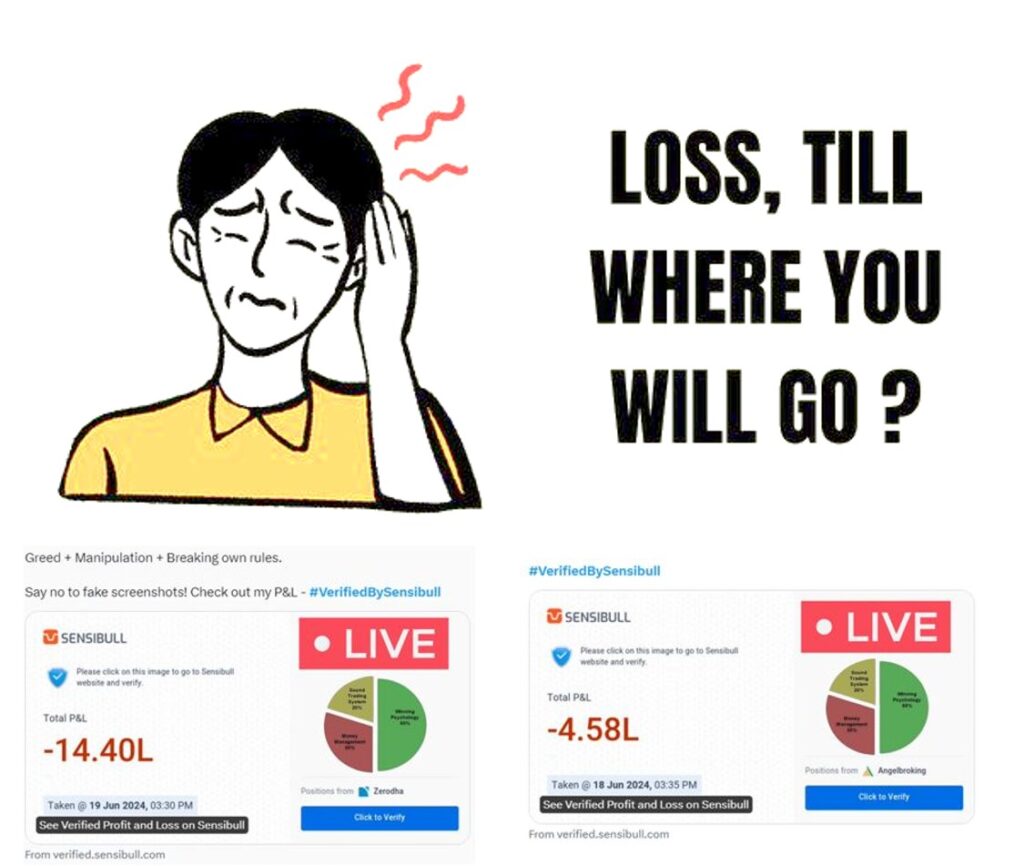

Emotions like fear or greed can push you to trade impulsively or hold losses too long. Learning trade psychology helps you stay calm and stick to your strategy, no matter the market’s ups and downs.