Introduction

Trading in the stock market, especially in options, is not just about numbers and charts. It’s also about managing emotions, understanding human psychology, and making informed decisions.

Many traders, despite having the technical knowledge, face losses due to fear and greed. This article delves into how these emotions can impact trading decisions and why mastering trading psychology is crucial for success.

The Emotional Rollercoaster of Trading:

Trading can be an emotional rollercoaster. The anticipation of potential profits, the fear of losses, and the greed for more can significantly impact a trader’s decisions. Let’s explore some real scenarios:

1. The Fear Factor in Trading

Fear is one of the most common emotions that affect traders. It can manifest in several ways:

- Fear of Missing Out (FOMO): Often, traders see a stock rapidly increasing in value and fear they will miss out on profits. This fear can lead to impulsive buying without proper analysis.

- Fear of Loss: This can paralyze traders, preventing them from taking necessary risks or closing positions at the right time, leading to larger losses.

2. The Greed Trap

Greed is another powerful emotion that can lead to poor trading decisions:

- Overtrading: Greed can drive traders to take on more trades than they can manage, often leading to significant losses.

- Holding Losing Positions: Traders might hold onto losing positions in the hope that the market will turn around, driven by greed to recover losses.

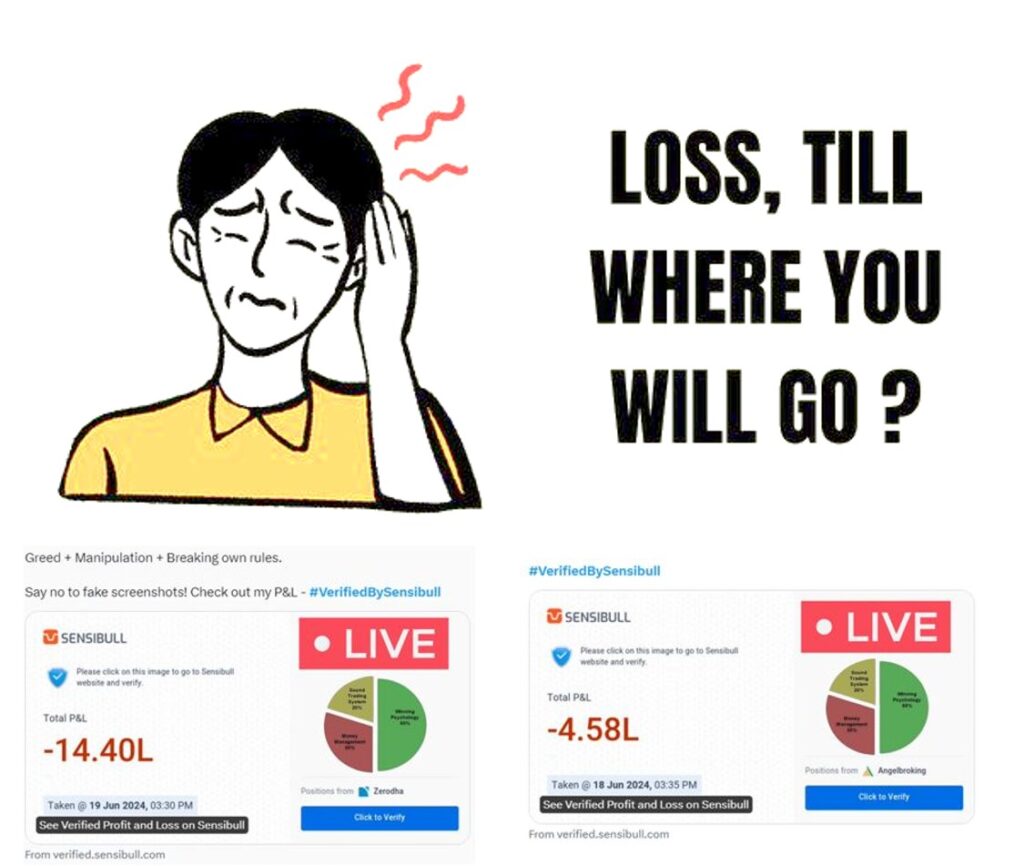

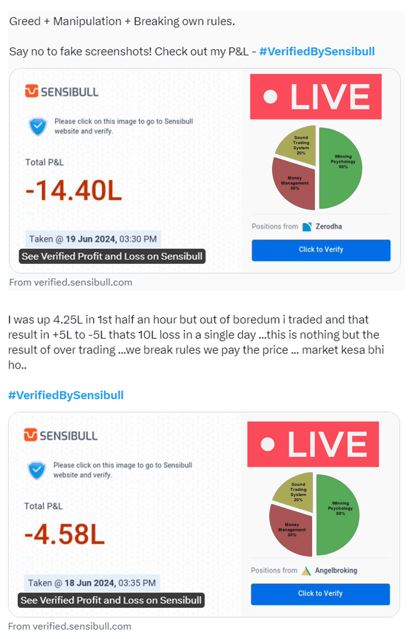

3. Real-World Examples of Trading Losses

Here are some common scenarios where traders face losses due to fear and greed:

- Intraday Losses: Many traders, especially in intraday trading, face losses due to quick, emotionally-driven decisions. Intraday loss screenshots often show how a small mistake can lead to significant losses.

- Option Trading Losses: Option trading, while potentially profitable, can also result in maximum losses if not approached with the right mindset.

The Importance of Trading Psychology:

Understanding and managing emotions is key to becoming a successful trader. Here’s why trading psychology matters:

4. Developing a Trading Plan

A solid trading plan helps mitigate the impact of emotions:

- Set Clear Goals: Define your profit targets and stop-loss levels before entering a trade.

- Stick to the Plan: Follow your trading plan strictly, regardless of market movements or emotional impulses.

5. Risk Management

Effective risk management strategies can prevent fear and greed from leading to significant losses:

- Diversify: Spread your investments across different assets to minimize risk.

- Position Sizing: Allocate a fixed percentage of your capital to each trade to avoid significant losses.

6. Emotional Discipline

Maintaining emotional discipline is crucial:

- Mindfulness and Meditation: Techniques like mindfulness and meditation can help traders stay calm and focused.

- Journaling: Keeping a trading journal to record emotions and decisions can provide insights into emotional patterns and help improve future trading strategies.

7. Learn from Losses

Every trader faces losses, but successful traders learn from them:

- Analyze Losing Trades: Review loss trades to understand what went wrong and how to avoid similar mistakes in the future.

- Accept Losses: Accept that losses are a part of trading and focus on long-term success rather than short-term gains.

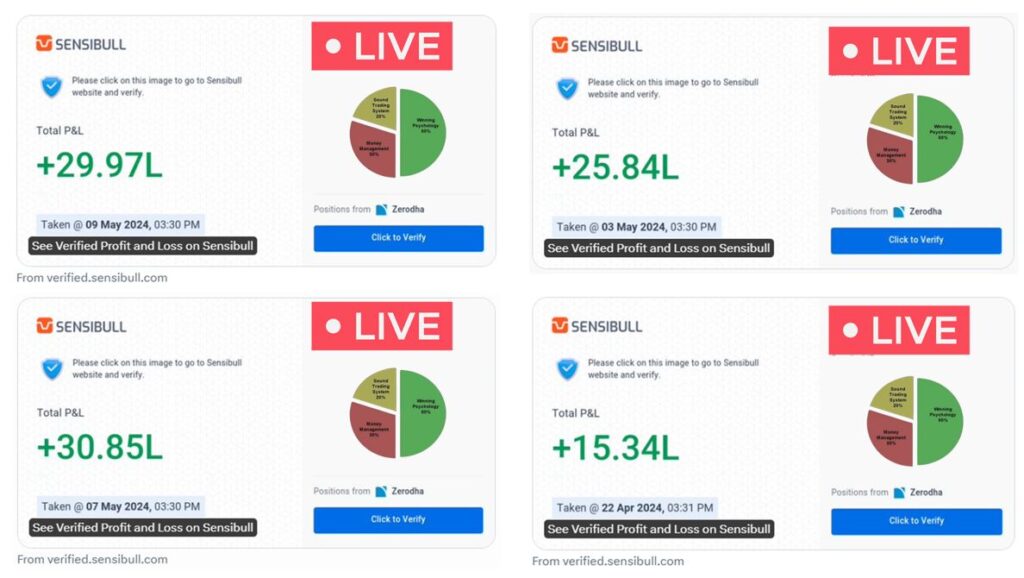

Success Stories: Profit Screenshots as Motivation

While it’s important to learn from losses, it’s equally crucial to stay motivated by acknowledging successes:

8. Celebrating Small Wins

Recognize and celebrate small victories to maintain a positive mindset:

- Profit Screenshots: Taking screenshots of profitable trades can serve as a reminder of successful strategies and boost confidence.

9. Long-Term Focus

Keep your focus on long-term goals rather than short-term profits:

- Compound Growth: Understand the power of compounding and aim for consistent, steady growth rather than quick, risky gains.

Success stories:

Watch the success stories from Trade_Psychology community on how traders have mastered the psychology behind trading!

Watch NowConclusion:

Mastering the psychological aspects of trading is as important as understanding technical analysis or market trends.

Fear and greed are powerful emotions that can lead to significant losses if not managed properly.

By developing a solid trading plan, practicing effective risk management, maintaining emotional discipline, and learning from both successes and failures, traders can navigate the challenging waters of the stock market more effectively.

Remember, trading is a marathon, not a sprint. Stay focused, stay disciplined, and success will follow.