Options trading and gambling are two terms that often evoke thoughts of risk, uncertainty, and the potential for big gains or devastating losses.

Many people wonder if options trading is simply a form of gambling or if there’s a more strategic aspect involved.

In this article, we will delve into the world of options trading to understand its key principles, assess the similarities and differences between options trading and gambling, and determine whether options trading is purely based on luck or if it involves skillful decision-making.

So, let’s explore the intricacies of options trading and uncover whether it’s a game of chance or a calculated financial endeavor.

Understanding Options Trading

Before we dive into the comparison between options trading and gambling, let’s establish a solid understanding of what options trading entails.

Options are financial instruments that provide individuals with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame.

Unlike traditional stock trading, where investors buy and sell shares of a company, options trading involves contracts that grant the holder the opportunity to purchase or sell these contracts.

There are two types of options: calls and puts. A call option provides the right to buy, while a put option gives the right to sell.

Options Trading vs. Gambling: Key Differences

While options trading and gambling share some commonalities, there are significant differences that set them apart. Let’s examine these distinctions:

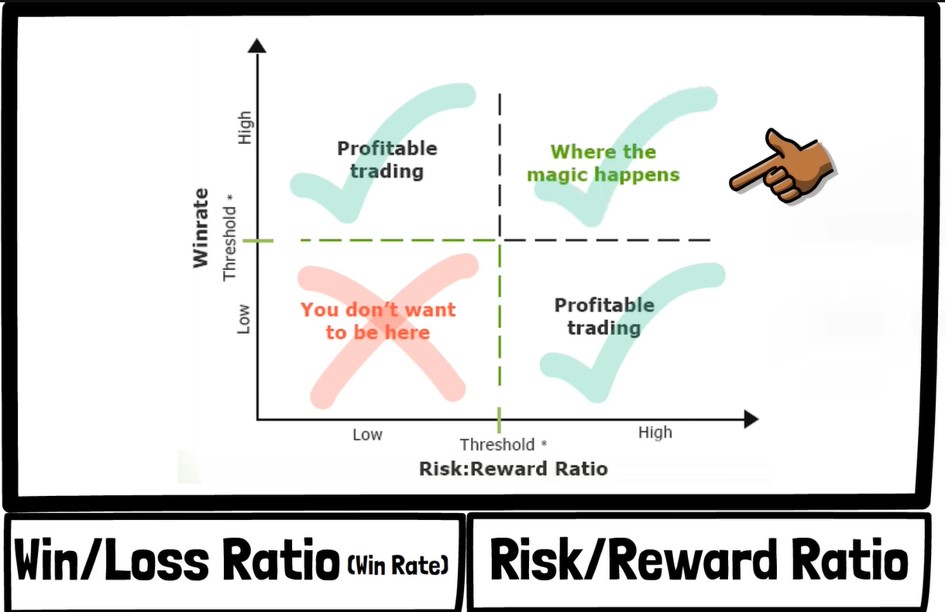

Risk Assessment: Options trading allows investors to analyze and assess the risk associated with a trade. Traders can employ various strategies, such as analyzing market trends, conducting fundamental analysis, and utilizing technical indicators to make informed decisions. Gambling, on the other hand, relies primarily on chance, without the ability to assess risk beyond basic probability.

Knowledge and Expertise: Successful options trading requires a deep understanding of the underlying asset, market conditions, and financial analysis. Traders need to keep themselves updated with news, trends, and company-specific information. Gambling, however, typically relies on luck rather than specialized knowledge or expertise.

Time Horizon: Options trading often involves a longer time horizon, with trades spanning weeks, months, or even years. Gambling, particularly in games like roulette or slot machines, offers near-instantaneous results.

Risk Management: Options traders have the advantage of employing risk management techniques to minimize potential losses. Strategies like stop-loss orders and hedging can help control risk exposure. In gambling, risk management is limited, and the outcome is usually binary—either a win or a loss.

Free course: Master Options Trading

Join our FREE options trading course and gain valuable insights into the world of options trading. Learn essential strategies, risk management techniques, and the keys to making informed decisions.

Learn nowSimilarities and Overlaps

While there are notable differences, it’s important to acknowledge that options trading and gambling share some common elements.

Both involve the potential for financial gain or loss, and they require individuals to commit funds with the expectation of a favorable outcome. In both cases, emotions and psychology play a significant role. Greed, fear, and the desire for instant gratification can influence decision-making in both options trading and gambling scenarios.

Determining the Skill Factor

One crucial aspect of the options trading versus gambling debate is the presence of skill in options trading.

While there is an element of chance in options trading, successful traders rely on a combination of analysis, strategy, and experience to increase the likelihood of profitable outcomes.

Skilled options traders understand risk management techniques, perform in-depth analysis of the market and underlying assets, and execute trades based on informed decisions.

FAQ’s:

Is options trading profitable?

Options trading has the potential for profitability, but it also carries inherent risks. Profits can be made by correctly predicting the direction of the underlying asset’s price movement within a specified time frame. However, it requires knowledge, skill, and a disciplined approach to consistently generate profits in options trading.

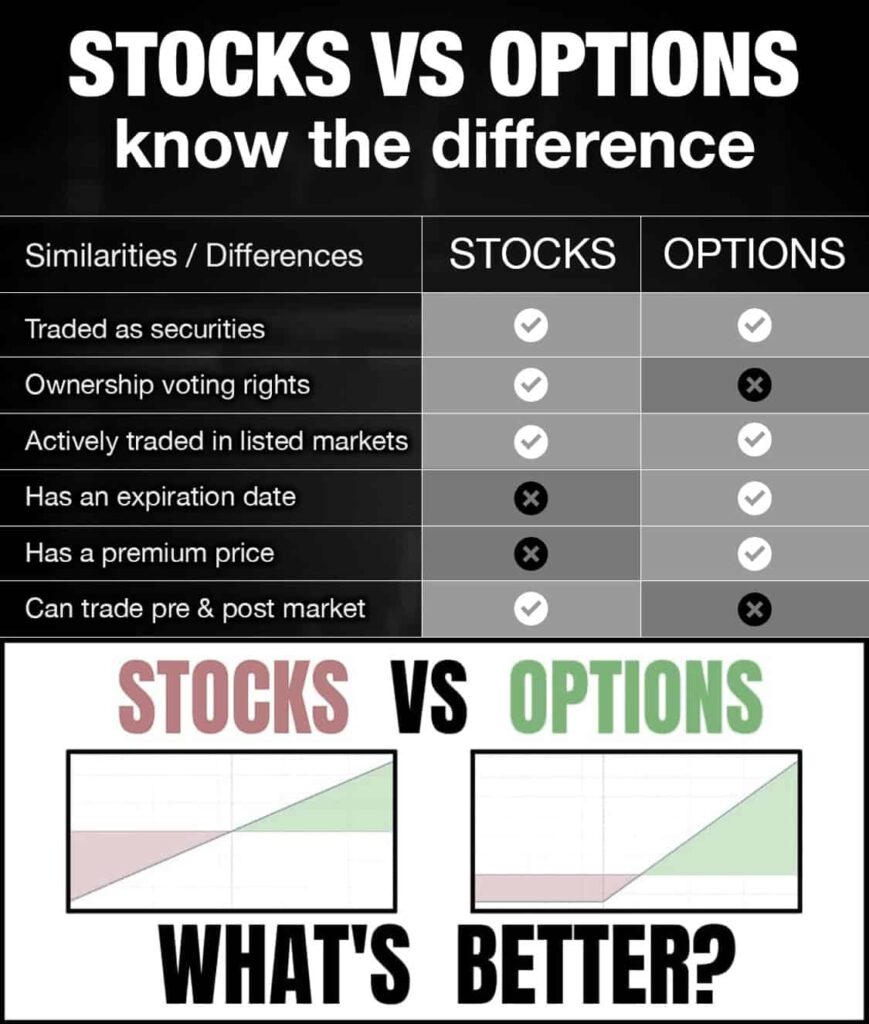

Is options trading better than stocks?

Comparing options trading to stocks is subjective and depends on individual preferences and investment goals. Options trading offers leverage, flexibility, and the ability to profit from both rising and falling markets. On the other hand, stocks provide ownership in a company and the potential for long-term growth. It’s important to evaluate personal risk tolerance, investment objectives, and market conditions when deciding which is better suited to one’s needs.

The truth about options trading?

Options trading is a complex financial instrument that requires understanding and skill. While it offers opportunities for potential profits, it also involves risks. Successful options trading requires careful analysis, risk management, and knowledge of market trends. It is not a guaranteed pathway to wealth and requires dedication and continuous learning to navigate the intricacies of the options market effectively.

Is options trading hard?

Options trading can be challenging, especially for beginners. It involves understanding concepts like strike prices, expiration dates, and option pricing models. Additionally, analyzing market trends and managing risk can be complex. However, with dedication, education, and practice, individuals can acquire the necessary skills to navigate the options market effectively.

Is options trading worth it?

Whether options trading is worth it depends on an individual’s financial goals, risk tolerance, and dedication to learning and mastering the craft. It offers opportunities for potential profits, hedging strategies, and portfolio diversification. However, it also carries risks and requires ongoing commitment to education and staying updated with market trends. Each person should carefully evaluate their personal circumstances and objectives before deciding if options trading aligns with their investment strategy.

Conclusion

In conclusion, while options trading and gambling share certain similarities, they are fundamentally different endeavors.

Options trading involves strategic decision-making, risk assessment, and the application of financial knowledge. It allows traders to manage risk and employ various strategies to increase their chances of success.

Free course: Master Options Trading

Join our FREE options trading course and gain valuable insights into the world of options trading. Learn essential strategies, risk management techniques, and the keys to making informed decisions.

Learn now