Time decay in options refers to the gradual erosion of the value of an option as time passes. It is an essential aspect to consider when trading or investing in options.

Options are versatile financial instruments that provide traders and investors with opportunities to profit from price movements in various underlying assets, such as stocks, commodities, or currencies.

While options offer flexibility, they also come with unique characteristics that require careful consideration. One of the critical factors that significantly influence option prices is time.

In this article, we will explore the effect of time on options, focusing on concepts such as time decay, time value, and theta decay, and we’ll also introduce the option premium calculator as a useful tool for assessing option prices.

The Time Value of Options:

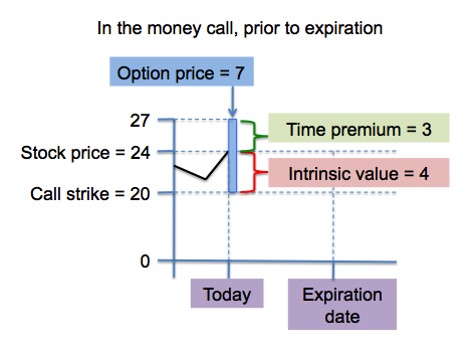

The time value of an option is influenced by various factors, including the time remaining until the option’s expiration, the volatility of the underlying asset, and the prevailing interest rates.

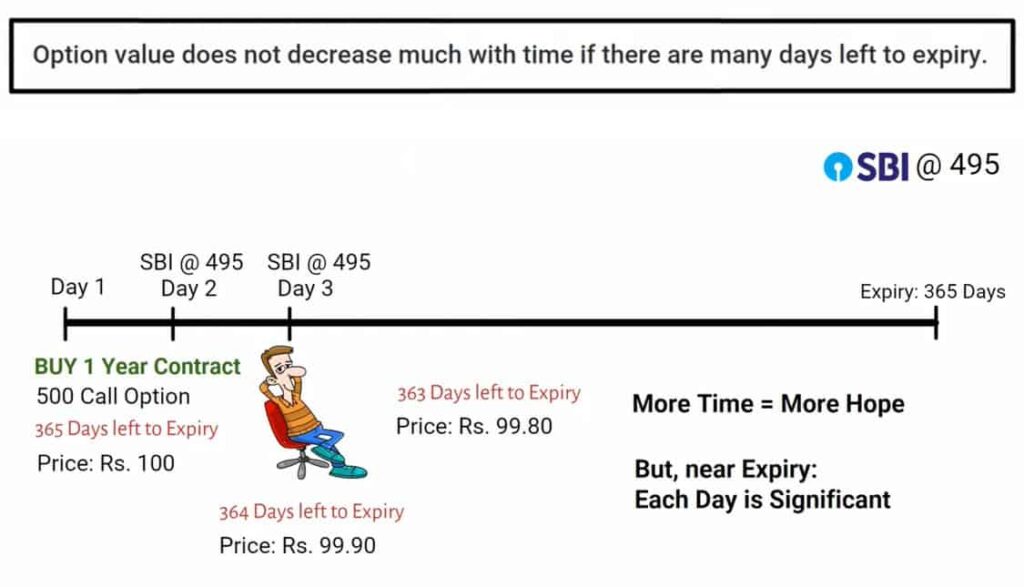

However, time itself plays a crucial role in determining the time value. As time passes, the likelihood of the option expiring in-the-money decreases, reducing its overall value. Consequently, options that have more time until expiration tend to have higher time values.

Theta Decay in Options:

Theta is one of the Greek letters used to quantify the impact of time decay on option prices. It represents the rate at which an option’s time value declines with each passing day.

Theta is a negative number, indicating that options lose value over time. The closer an option is to its expiration date, the higher the rate of time decay.

- Consider a scenario where you purchase a call option on the Indian Rupee with a strike price of 75 against the US Dollar.

- The option premium is ₹3, and it expires in one month.

- Over the course of the month, as time passes, the option’s time value begins to erode due to time decay.

- Suppose that after two weeks, the exchange rate remains unchanged at 74.50.

- Due to time decay, the option’s premium might decrease to ₹2.80, reflecting the diminishing time value.

- This example showcases how time decay can gradually eat away at an option’s premium, impacting its overall profitability.

Free course: Master Options Trading

Join our FREE options trading course and gain valuable insights into the world of options trading. Learn essential strategies, risk management techniques, and the keys to making informed decisions.

Learn nowOption Premium Calculator: A Handy Tool:

To assess the impact of time decay on options accurately, traders and investors often utilize an option premium calculator. This tool provides insights into the potential price changes an option may experience due to time decay.

By inputting the relevant data, such as the current option price, the time until expiration, the underlying asset’s volatility, and the prevailing interest rates, traders can estimate the effect of time on option prices.

The option premium calculator takes into account the option’s Greeks, including theta, to determine the expected change in the option’s value as time progresses. This tool can be particularly useful for traders implementing options strategies that involve holding positions over an extended period.

Options Theta Decay Calculator

Conclusion:

Time plays a significant role in determining the value of options. Time decay, also known as theta decay, leads to a gradual erosion of an option’s time value as time passes. Options with less time remaining until expiration are more susceptible to time decay, leading to a faster decline in their premium. Understanding and managing the effect of time decay is crucial for options traders and investors to make informed decisions.

Utilizing tools like the option premium calculator can assist in assessing the potential impact of time decay on option prices accurately. By considering the concepts of time decay, time value, and theta decay, traders can navigate the options market more effectively and adjust their strategies accordingly. Remember, while time decay can work against option buyers, it can work in favor of option sellers who take advantage of the diminishing time value in options.

By keeping an eye on the clock and employing appropriate strategies, investors and traders can harness the power of time to their advantage in the options market.

Free course: Master Options Trading

Join our FREE options trading course and gain valuable insights into the world of options trading. Learn essential strategies, risk management techniques, and the keys to making informed decisions.

Learn now