Options Chain Analysis in NSE INDIA

Option Chain Analysis is a powerful tool that can provide valuable insights into the dynamics of the options market.

As an intraday trader, understanding and effectively using the NSE India Option Chain can enhance your decision-making process and potentially improve your trading outcomes.

In this article, we will delve into the basics of using the option chain for intraday trading and explore some strategies that can be employed to make informed trading decisions.

Understanding NSE India Option Chain:

The NSE India Option Chain is a comprehensive display of available options contracts for a particular underlying asset, such as the Nifty index.

It provides vital information such as strike prices, call and put options, premiums, and open interest. The option chain can be accessed through various financial platforms and websites.

Key Terms in Option Chain:

LTP (Last Traded Price): LTP refers to the most recent price at which an option contract was traded. It provides the current market value of the option.

Ask Qty (Quantity): Ask Qty represents the number of option contracts available for sale at a given ask price. It indicates the selling interest in a particular option.

Free course: Master Options Trading

Join our FREE options trading course and gain valuable insights into the world of options trading. Learn essential strategies, risk management techniques, and the keys to making informed decisions.

Learn nowUsing Option Chain Analysis for Intraday Trading:

-

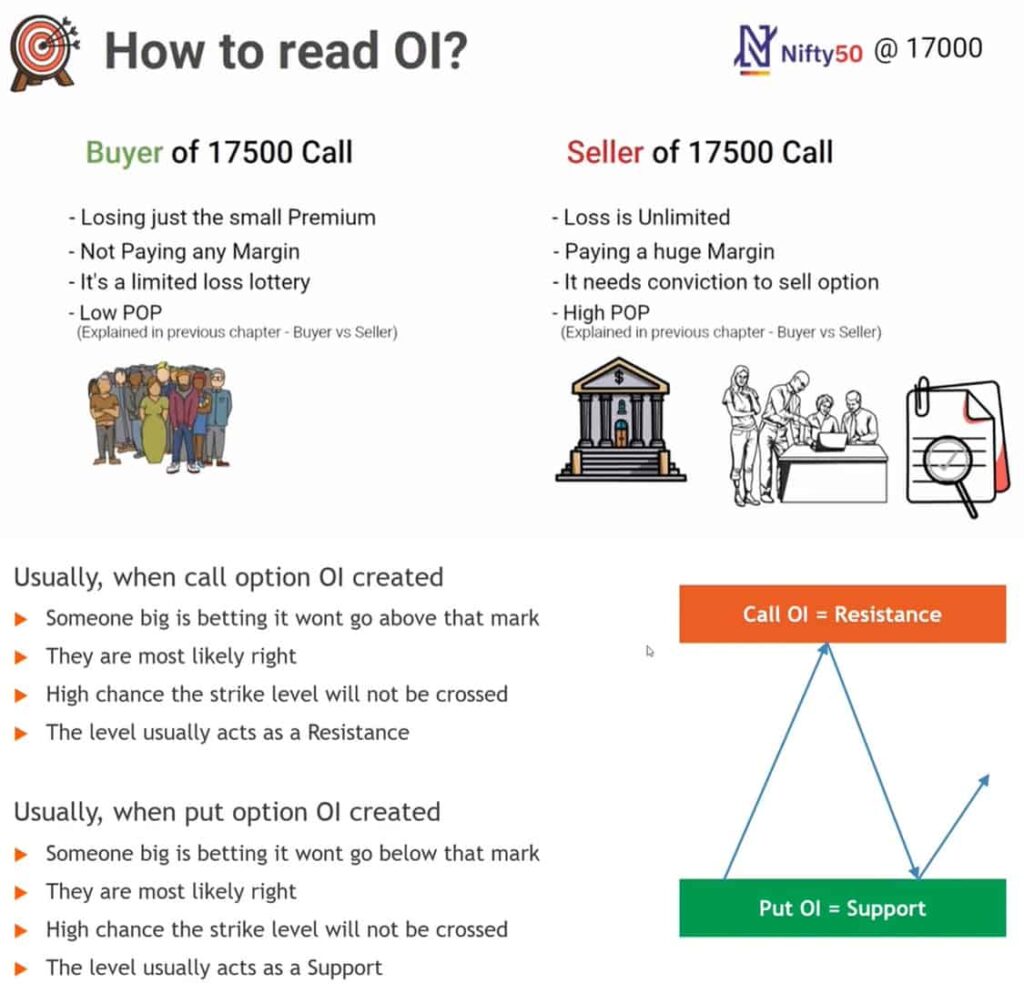

Identifying Support and Resistance Levels: The option chain can help you identify significant support and resistance levels for the underlying asset. These levels indicate price zones where the market tends to react, resulting in potential reversals or breakout opportunities. By analyzing the open interest and trading volumes at different strike prices, you can identify these crucial levels. For example, let’s say the Nifty option chain shows significant open interest at the 15,000 strike price for calls. This suggests a strong resistance level, indicating a possible reversal if the index approaches that price.

-

Gauging Market Sentiment: Option Chain Analysis allows you to gauge market sentiment by examining the concentration of open interest in call and put options. Higher open interest in call options indicates bullish sentiment, while higher open interest in put options suggests bearish sentiment. By monitoring changes in open interest throughout the trading day, you can identify shifts in market sentiment and make appropriate trading decisions.

-

Analyzing Implied Volatility: Implied Volatility (IV) represents the market’s expectation of the underlying asset’s price volatility. By analyzing the option chain, you can determine the implied volatility levels for different strike prices and expiry dates. Higher implied volatility suggests greater price fluctuations and potential trading opportunities. Comparing IV across different strike prices can help you identify undervalued or overvalued options, enabling you to make strategic trading decisions.

-

Employing Option Chain Strategies: Option Chain Analysis can assist in formulating trading strategies based on the available information. Popular strategies include the Bull Call Spread, Bear Put Spread, Long Straddle, and Short Straddle. These strategies involve combining different call and put options to capitalize on specific market expectations. By analyzing the option chain and selecting appropriate strike prices and expiry dates, you can implement these strategies effectively.

Conclusion:

The NSE India Option Chain is a valuable tool for intraday traders to make informed trading decisions.

By understanding the various components of the option chain and employing strategies based on the information provided, traders can potentially enhance their profitability.

Remember to continuously monitor the option chain throughout the trading day to stay updated on market sentiment and identify potential opportunities. With practice and experience, option chain analysis can become an integral part of your intraday trading toolkit.

Free course: Master Options Trading

Join our FREE options trading course and gain valuable insights into the world of options trading. Learn essential strategies, risk management techniques, and the keys to making informed decisions.

Learn now