Learn how to trade Intraday Futures & Options Profitably with pattern trading!

Price Action pattern trading is one of the most profitable Intraday Trading Strategy for Futures & Options.

How to trade Intraday F&O?

In this webinar you will learn;

- How to trade Intraday Options?

- How to follow Intraday patterns?

- The secret behind consistent profit generation strategy!

- How to trade weekly Options Profitably? [Bonus content]

Before learning to trade Intraday you need to know this:

- Intraday trading is a job, not a hobby; you need to have experience in it.

- Intraday trading requires your time. You'll need to give up most of your day,

- You need to be Realistic About Profits A strategy doesn't need to win all the time to be profitable. Many traders only win 50% to 60% of their trades.

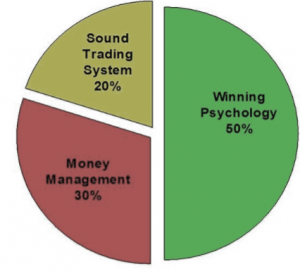

So, their are many things you need to know to become a full-time Intraday trader, let me simplify this for you, Following are the top skills you need to know to become professional Intraday Trader:

- Technical Analysis or chart reading skills

- Money Management skills

- Trading psychology skills etc.

You may be a beginner or you have some experience in day trading, but based on statistics we can say that to be a profitable Intraday trader you need to take mentor-ship from experienced traders, which you can follow their strategies to be profitable.

We have been trading Intraday profitably since from past 8 years & based on our experience we have discovered the best strategy that works till now is following Price action strategy.

If you are Interested to learn in-depth with real case studies, we have developed an eBook on Price Action Trading, please have a look.

Price action trading eBook for Intraday Trading:

What you will learn:

- Basic of candlesticks

- Trend trading techniques

- Breakout Trading strategies

- Pattern Identification techniques

- Divergences in Intraday trading

Not only theory:

We have explained 27 trades on how we traded Bank Nifty Futures with price action strategies & making over 28.73 % in 3 months.

If you want to upgrade your technical skills & improve your trading consistency by following profitable Intraday patterns then, “Intraday Trading Master Course” is the best choice for you.

Intraday Trading Master Course

Learn how to win Intraday trades by Mastering the Intraday Trading patterns with live case studies & Mobile trading techniques to achieve consistency from Intraday Trading course.

Following are the key features:

- Overall 4 modules with 18 Lessons

- Animated video lessons & case studies

- over 3+ hours of training content

- Interactive live trade analysis

- All lessons in Hindi / English language

- Bonus topic on “Mobile Trading“

High probability Strategy

You will learn how to place high probability Intraday trades

Money management

Learn how to manage funds based on varying market conditions

Chart Reading skills

Learn how to identify Intraday trend & executing trading plan

Trading Psychology

Master your trading psychology for consistent results

Intraday Trading Performance

Frequently Asked Questions?

Following are the advantage of price action trading:

- Most of the professional traders use price action strategies

- Indicators are lagging because indicators are defined by price value

- Price action can work on any script & at any time frame

- Most of the price action patterns are repeatable

Our “Intraday Trading Master Course” is designed from basic step-by-step approach that will guide you with proven case-studies & examples, where you can learn within 15 days.

Yes, In “Intraday Trading Master Course” we have covered basic of candlesticks to analyzing multi-time frame analysis to identify trends in any market either INDEX or stocks.

For FY 19-20 we had achieved 42.86% returns with Nifty & Bank Nifty weekly Options with draw-down of -8% in a month, Along with weekly Options we do trade Expiry day selling which generated a combined returns of 76.13% with weekly Options.

When It comes to Intraday trading no patterns works perfect, you need to back-test these patterns to know which patterns works best for you, In our “Intraday Trading Master Course” we have explained 4 best Intraday trading setups with live trades So, you can just follow these patterns to achieve consistency.

Have Queries?

Get in touch with us trough Live chat, we area available live.

100% customer satisfaction Guarantee!

Based on our past enrolled students we guarantee you that we offer more than 100% value for what you pay.